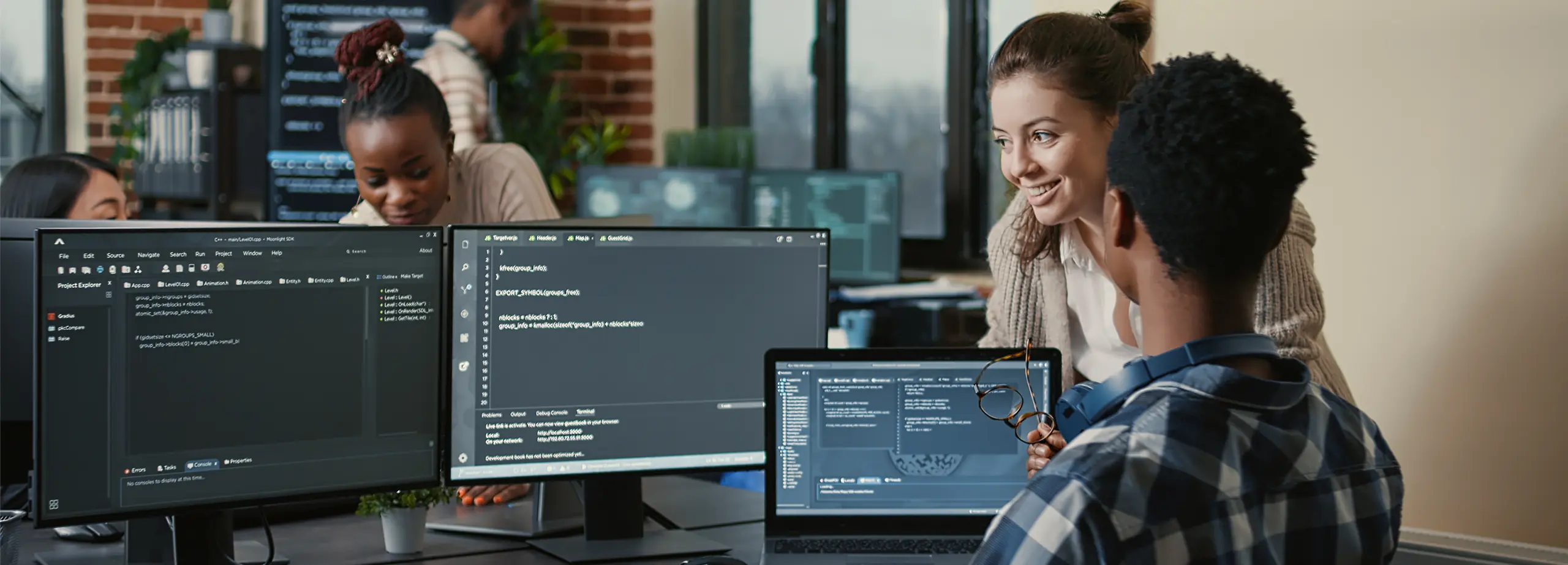

Machine learning (ML) has surfaced as a game-changing influence in multiple industries, dramatically reshaping the banking, financial services, and healthcare landscape. With its proficiency in processing large quantities of data and generating predictions, machine learning is progressively becoming more valuable.

This blog will examine some of the most significant machine learning trends currently shaping the banking and financial services industry, including churn management, customer segmentation, underwriting, marketing analytics, regulatory reporting, and debt collection. We will also delve into the machine learning trends in healthcare sector, highlighting disease risk prediction, patient personalization, and automating de-identification.

These trends are supported by insights from leading market research firms like Gartner and Forrester and consulting firms like McKinsey, BCG, Accenture, and Deloitte.

ML Trends in Banking and Financial Service Industry

Churn management is a critical concern for banking and financial service providers. Machine learning algorithms can analyze customer behavior, transaction history, and interaction patterns to identify potential churn indicators. By detecting early signs of customer dissatisfaction, businesses can proactively engage customers and offer tailored solutions to retain them.

Example: Citibank implemented a machine learning system to predict customer churn by analyzing transactional data and customer interactions. This approach helped Citibank reduce customer churn by 20% and increase customer retention.

Machine learning enables accurate customer segmentation, allowing banks and financial institutions to understand their customer base better. ML algorithms can analyze customer data, including demographics, transaction history, and online behavior, to identify distinct customer segments with specific needs and preferences. This information empowers businesses to create targeted marketing campaigns, personalized offerings, and tailored customer experiences.

Example: A leading financial institution employed machine learning to segment its customers based on their financial goals, spending patterns, and risk appetite. By tailoring their product offerings to each segment, the institution achieved a 15% increase in cross-selling and improved customer satisfaction.

In the banking and financial services industry, underwriting is a critical process for assessing loan applications and managing risk. Machine learning algorithms can analyze large amounts of data, including credit scores, financial statements, and historical loan data, to automate and enhance the underwriting process. ML-powered underwriting systems can provide faster and more accurate risk assessments, leading to efficient decision-making and improved loan portfolio quality.

Example: LendingClub, an online lending platform, utilizes machine learning to assess borrower creditworthiness. By analyzing various data points, such as income, credit history, and loan purpose, LendingClub’s machine learning models have improved loan approval accuracy and reduced default rates.

Machine learning empowers banks and financial institutions to better understand customer behavior and preferences, enhancing marketing effectiveness. ML algorithms can analyze customer data, social media interactions, and campaign responses to identify trends, patterns, and customer preferences. This enables businesses to create targeted marketing strategies, optimize campaign performance, and improve customer acquisition and retention rates.

Example: Capital One employs machine learning to personalize marketing offers for credit card customers. By analyzing customer data, spending patterns, and demographic information, Capital One delivers tailored offers, resulting in increased response rates and improved customer engagement.

Regulatory compliance is a significant concern for banks and financial institutions. Machine learning can automate and streamline the regulatory reporting process by analyzing and extracting relevant information from vast amounts of data. ML algorithms can ensure accuracy, identify anomalies, and provide real-time insights, enabling timely compliance with regulatory requirements.

Example: JPMorgan Chase leverages machine learning for regulatory reporting by automating data extraction and verification. This approach has improved accuracy, reduced reporting errors, and increased operational efficiency.

Machine learning can improve debt collection processes by identifying the most effective strategies and predicting the likelihood of repayment. ML algorithms can analyze customer payment history, communication patterns, and external data sources to prioritize collection efforts, tailor communication channels, and optimize resource allocation.

Example: American Express implemented machine learning algorithms to predict the likelihood of customers falling behind on payments. By proactively engaging at-risk customers and offering tailored payment plans, American Express reduced delinquency rates and improved collections efficiency.

ML Trends in Healthcare Industry

Machine learning algorithms can analyze large amounts of patient data, including medical records, genetics, and lifestyle factors, to accurately predict disease risks. By leveraging these predictions, healthcare providers can proactively intervene, develop personalized prevention plans, and improve patient outcomes.

Example: Google’s DeepMind developed a machine learning model to predict the risk of developing acute kidney injury (AKI). The model enabled healthcare professionals to identify at-risk patients earlier by analyzing patient data, allowing for timely intervention and reduced AKI incidence.

Machine learning enables personalized healthcare by analyzing patient data to tailor treatment plans, medication dosages, and therapies to individual characteristics and needs. This approach, known as precision medicine, improves patient outcomes and minimizes adverse effects.

Example: Memorial Sloan Kettering Cancer Center employed machine learning to personalize cancer treatment recommendations. The algorithm helped oncologists determine the most effective and personalized treatment plans by analyzing patient data, including genetic information and treatment history.

To comply with privacy regulations, healthcare providers must de-identify patient data before sharing it for research or analysis. Machine learning can automate de-identification by accurately removing or encrypting personally identifiable information (PII) while preserving data utility.

Example: The National Institutes of Health (NIH) developed machine learning models to automate the de-identification of medical records. This approach increased efficiency, reduced human error, and ensured compliance with privacy regulations.

Conclusion

In conclusion, the financial services and healthcare industries are undergoing a significant transformation driven by machine learning technologies. As these machine learning trends evolve, we expect to see more sophisticated applications that enhance decision-making, improve operational efficiency, and deliver personalized customer experiences. By embracing machine learning, organizations in these sectors can unlock valuable insights from their data, streamline processes, and stay ahead of the competition.

However, it is essential for businesses to not only adopt these technologies but also invest in the necessary infrastructure, skilled workforce, and data management practices. This will ensure that they can fully harness the power of machine learning and capitalize on its potential to drive innovation and growth. As we move forward, the financial services and healthcare industries will undoubtedly continue to be at the forefront of machine learning advancements, setting new benchmarks for other sectors.