When it comes to human experience, businesses often prioritize progress and efficiency, striving to optimize processes and maximize outcomes. However, in this pursuit, there is a risk of losing sight of the human element—the intricate and often unpredictable journeys customers embark on. By shifting the focus from progress to embracing authenticity and genuine human connection, companies can create meaningful and lasting experiences that resonate with customers on a deeper level.

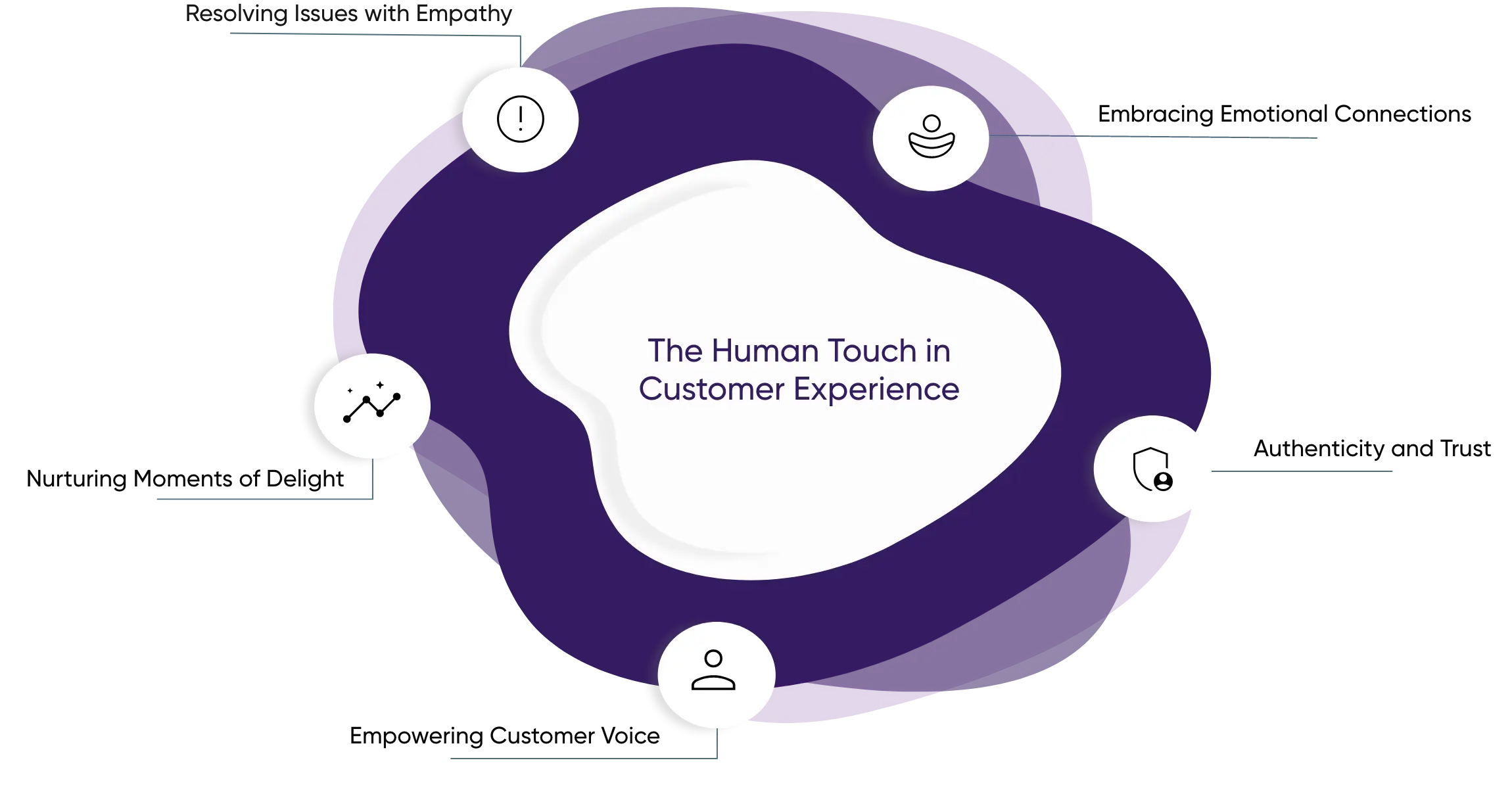

The Human Touch in Customer Experience

Embracing Emotional Connections

Customers are not just transactions but individuals with emotions, desires, and values. Recognizing and understanding the emotional aspects of their journeys allows businesses to connect with customers more profoundly. By fostering empathy, actively listening, and holistically addressing their customers’ needs, companies can create an emotional bond beyond mere transactions.

Authenticity and Trust

In a world saturated with marketing messages, customers crave authenticity. When businesses prioritize building genuine relationships over pushing sales, trust is established. By consistently delivering on promises, being transparent, and valuing open communication, companies can foster the trust that forms the foundation of long-term customer loyalty.

Empowering Customer Voice

Customers want to be heard and have their opinions valued. By actively seeking feedback, whether through surveys, reviews, or social media, businesses demonstrate their commitment to understanding and meeting customer expectations. Empowering customers to contribute to shaping products, services, and experiences creates a sense of ownership and strengthens the bond between the customer and the brand.

Nurturing Moments of Delight

Human journeys are filled with small moments that have the potential to create lasting memories. Businesses can create positive associations and leave a lasting impression by focusing on delighting customers at various touchpoints along their journey. It could be a personalized message, a surprise gift, or simply going the extra mile to exceed expectations. These small acts of thoughtfulness have the power to turn customers into brand advocates.

Resolving Issues with Empathy

No journey is without its challenges. When customers encounter issues or problems, how a company responds can make all the difference. By approaching these situations with empathy, actively listening, and working towards a satisfactory resolution, businesses can turn a negative experience into an opportunity to strengthen the customer relationship. Demonstrating a genuine concern for the customer’s well-being and taking responsibility for rectifying any issues builds trust and loyalty.

Conclusion

In a customer-centric world, businesses must shift their focus from internal processes to the journeys customers undertake. Companies can build deeper connections, deliver personalized experiences, and cultivate long-term loyalty by understanding and prioritizing human journeys. In a world where progress often overshadows the human touch, organizations prioritizing the authenticity of these journeys will succeed in building strong and loyal customer relationships. Ultimately, it is the human element that makes customer experiences genuinely remarkable and memorable. By placing the customer and their emotions at the forefront, organizations can differentiate themselves in a crowded marketplace and build lasting relationships that drive success.

Recent Comments